• BENEFIT •

Due to the high volatility of crypto currencies quotation within very short time span and since the crypto market is open 24 hours a day 7 days a week, it is mandatory to protect open positions by means of “Stop Loss” instruments.

If you BUY a Call or a Put the risk is to lose 100% of the price paid but if you SELL a Call or a Put your loss can be unlimited!!!

As an example, for this latter case, you can see the differences when SELLING a Put followed by a negative movement of the BTC quotation with and without Option Guard “Stop Loss” protection by comparing the screenshots taken from an operational Deribit account that uses a high leverage:

1. On June 11th 2022 at 12:57 with BTC quotation at 28.563 USD this put was sold:

“13 June 2022 Strike 27.500 at 0,0060 BTC” and immediately was set an Option Guard 50% “Stop Loss” protection “Market order at 0,0090 BTC”.

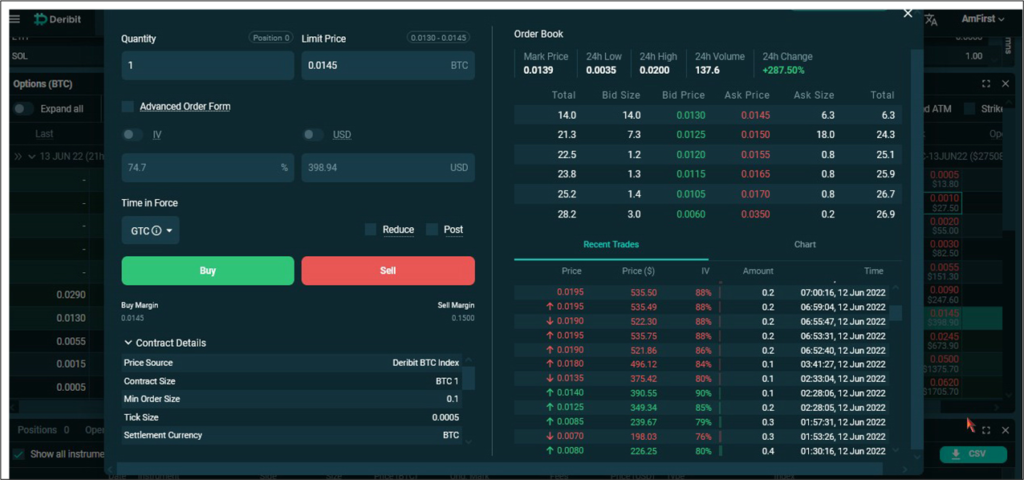

During June 12th night, with Deribit platform unattended by the user, the BTC quotation went quickly down to 27.896 USD, hence, as shown in the Order Book, at 02:28:05 the Put price went to 0,0125 BTC.

Option Guard at 02:28:06 placed the “buy” Market order to close the position, as shown in the Trade History, at 0,0140 BTC accruing 133% Loss.

Due to the fact that the order book was empty, the Loss was higher than the 50% planned, but nevertheless Option Guard succeeded in closing the position limiting the loss which would have been significantly higher because the Put price went to 0,0195 BTC short after Option Guard action, therefore avoiding a potential loss of 225%.

2. On June 12th 2022 at 18:57 with BTC quotation at 27.300 USD this put was sold:

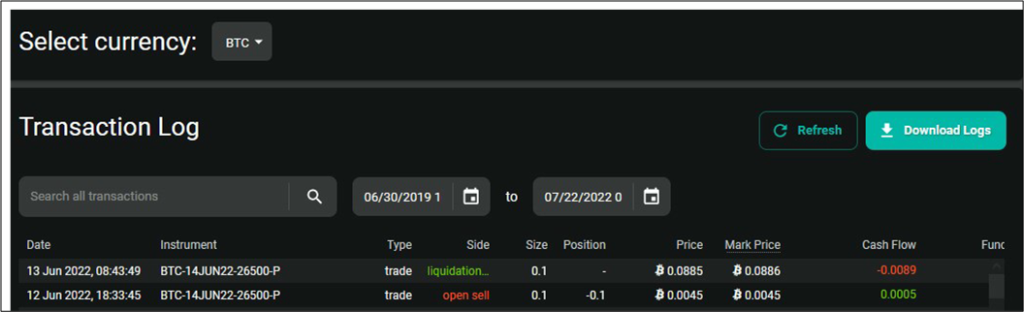

“14 June 2022 Strike 26.500 at 0,0045 BTC” and no Option Guard “Stop Loss” protection was set.

During the night, with Deribit platform unattended by the user, the BTC quotation went quickly and sharply down.

When 23.900 USD quotation was reached, due to the Margin Balance of the Account being below the Maintenance Margin requirement set by Deribit platform operational regulation and before the option’s natural expiration, on 13 June 2022 at 08:43 the platform automatically closed the position at 0,0885 BTC as shown in the Transaction Log.

Therefore, without any Option Guard “Stop Loss” protection in place, this position accrued a huge loss of approximately 1.800%.

It must be highlighted that if you SELL a Call or a Put you cannot place a parallel BUY order acting as “Stop Loss” to protect the position because the Exchange would execute it immediately with a sure loss!

Instead with Option Guard you can set the desired “Stop Loss” parameter and the BUY order will be filled automatically only when the condition you chose is met.